Beyond the Sale: Why Exit Planning Is About Legacy, Not Just Liquidity

For many business owners, the idea of selling their company begins with numbers—valuations, taxes, proceeds, and timelines. Yet recent research from the Exit Planning Institute reveals that only 41% of owners have a documented exit plan, despite three out of four hoping to exit within the next decade.

The gap between intent and preparation is striking, but more importantly it’s what the gap represents: a missed opportunity to not only secure financial outcomes, but also to define the legacy of a lifetime’s work.

THE PLANNING GAP IS REALLY A PERSPECTIVE GAP

It’s tempting to treat exit planning as something to tackle only when the end of a business journey nears, but the absence of planning often demonstrates:

- Postponed reflection on what truly matters

- Uncertainty around continuity

- Lost opportunity to shape how the business story is told after you step away

Recent Gallup research* shows that among U.S. business owners preparing to exit, about one-third have no long-term succession plan or are uncertain about the future of their business. When you expand that view to all business owners, including those who may never formally sell, the research shows that the number climbs to nearly half—business owners either expect to simply close their business or have admitted they don’t know what will happen next.

This gap isn’t just technical—it’s a missed opportunity to shape the story of your business with intention rather than leaving it to chance.

What’s more, the timeline of a business sale is often underestimated.

Why the Timeline Matters

The sale process takes longer than most realize:

- Smaller businesses: 6–9 months

- Mid-market/complex companies: 12–18 months

- If challenges arise: valuation gaps, financing delays, or buyer withdrawal can stretch to two years or more

Our advisors at Clearstead recommend beginning the planning process 2–5 years, at minimum, in advance: this way, when the sale itself begins, you’re prepared to move with clarity and confidence.

LEGACY: THE OFTEN-OVERLOOKED DIMENSION OF AN EXIT

A business sale is not just a financial transaction—it is a turning point that echoes beyond the closing table. Legacy can take many forms:

- Family security

- Continuity for employees

- Philanthropic funding

- Freedom to start something new without jeopardizing what’s been built

Unfortunately, many owners overlook the legacy dimension. Nearly two-thirds of family businesses don’t have a documented and communicated succession plan (Source: U.S. Small Business Administration). And across the broader market, only 30% of small businesses successfully sell, leaving the majority without a buyer—or a plan for what happens next (Source: Exit Planning Institute).

Simply put, legacy doesn’t happen by accident. It requires intention and intention requires planning.

WHY IS THERE OFTEN A HOLDUP?

From years of working with business owners, we’ve seen a common pattern: exit planning is often postponed until the last moment. The reasons differ, but they are familiar and deeply human. Clearstead advisors often see four common barriers:

Day-to-Day Pressures: Owners wear many hats and push planning to “later.”

Owners often run at full speed, wearing too many hats, and view planning as a task for a later date. In our experience, this owner dependency not only crowds out reflection, but it can also diminish business value in the eyes of buyers.

Misconceptions About Timing: Many assume six months is enough.

We frequently meet owners who assume planning should begin six months before a sale. In reality, most transactions require years of preparation, especially because waiting risks limiting your options.

Confidence Without Context: Casual buyer interest isn’t a plan; preparation must be deliberate.

It’s natural to benchmark against peers or assume casual buyer interest is enough, but a business sale requires deliberate development—financial, operational, and emotional.

Emotional Ties: A business can represent identity and purpose.

For some, the business represents their identity and purpose in life. Even raising the question “What comes next?” can feel overwhelming and hard to face. Yet, ignoring those emotions doesn’t remove them—it only compresses them into the sale process.

We’ve seen these barriers firsthand. And although understandable, they underscore the need to reframe exit planning as a form of life planning—not just another operational burden. When owners shift perspective, exit planning becomes less about the transaction alone, and more about clarity, alignment, and legacy.

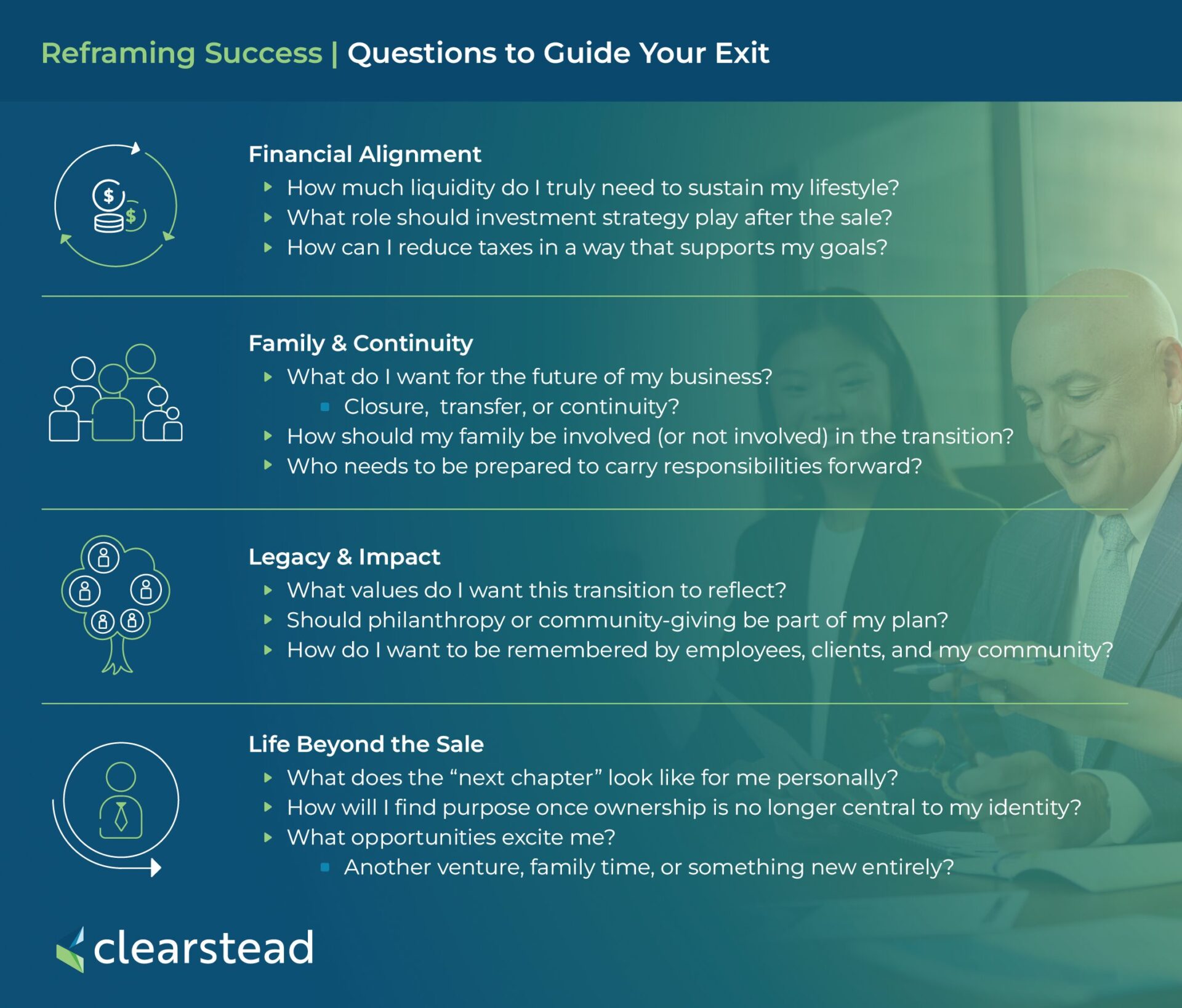

REFRAMING SUCCESS

A successful exit is not measured solely by valuation multiples. Success is alignment of:

- Financial outcomes with personal values

- Liquidity with long-term continuity

The most effective exit plans are holistic, weaving together tax strategy, estate planning, investment management, and succession considerations. In doing so, they create not only a roadmap for the transaction, but a foundation for the next chapter of your life.

A THOUGHTFUL FIRST STEP

At Clearstead, we often remind owners that exit planning is life planning. Numbers matter, but wisdom lies in context—in understanding how those numbers translate into family security, community impact, and personal freedom.

The question is not simply “What is my business worth?” but rather “What do I want this transition to mean—for me, for those I care about, and for the legacy I hope to leave?”

CONTINUE THE REFLECTION

To help frame the journey, we’ve developed a comprehensive guide. Download our whitepaper, Planning the Exit: A Financial Guide for Business Owners, for a deeper exploration of how to align financial strategy with the legacy you envision.

This whitepaper explores how to:

- Align financial strategy with legacy goals

- Understand the real timelines of exit planning

- Balance liquidity with continuity

KEY TAKEAWAYS

- Exit planning gaps are perspective gaps, not just technical oversights.

- Legacy is the overlooked dimension—family, employees, community.

- Success = alignment of values and outcomes, not just valuation multiples.

- Planning takes years, not months—begin 2–5 years out.

- A documented plan protects both financial results and personal legacy.

*3/24/2025

Disclosures: The information provided is general in nature, is provided for informational purposes only, and should not be construed as financial, tax, or legal advice. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All financial decisions must be evaluated as to whether it is consistent with your objectives and financial situation. You should consult with a financial, tax or legal professional before making any decisions.