OBSERVATIONS

- Amid a narrow tech-driven market landscape, markets were mixed last week with the S&P 500 gaining 0.7%, while small caps (Russell 2000) lost 1.4%. Meanwhile the yield on the 10-year Treasury gained 8 basis points to end the week at 4.08%.[1]

- The S&P CoreLogic National Housing Price Index showed that home price appreciation continued to slow in August (latest available) with home price increases slowing to 1.5% year-over-year (YoY) which was below July’s 1.6% YoY increase.[1]

- The Conference Board’s Consumer Confidence Index eased down by 1.0 point to 94.6 in October from September’s figure of 95.6. Consumers felt marginally better about their current situation in October compared to September, but in contrast, their short-term expectations for income, business, and labor market conditions fell compared to September.[1]

EXPECTATIONS

- President Trump and Chinese President Xi met last week at the APEC Summit in South Korea and agreed to trade regime framework that should lower tariffs on Chinese goods to about 47%, allow for the Chinese exports of rare earth minerals and products to the US, increase US agricultural imports to China, and curb the exports of Fentanyl and other synthetic drug pre-cursor chemicals.[1] The final details are likely to emerge in the coming months, but the trade détente helped buoy markets last week—see One More Thought.

- The Fed cut its main policy rates by 25 basis points last week to 3.75% – 4.00% in line with expectations. However, during the press conference that followed, Fed Chairman Powell emphasized that another rate cut at its next meeting was not predetermined and that there were “strongly different views about how to proceed in December.” As a result, the Fed Fund Futures re-priced the likelihood of a December rated cut from 92% before the Fed meeting to 68% last Friday.[1]

- The European Central Bank, which last cut rates in June, continued to hold rates steady and indicated European rates were in a “good place”. Meanwhile, the Bank of Canada reduced its main policy rate by 25 basis points but signaled that it was likely done with rate cutting going forward.[1]

- Last week saw a large number of companies report Q3 earnings including mega-cap names Meta, Apple, Microsoft, Amazon and Alphabet. With 64% of the S&P 500 having reported, the number of companies with a positive earnings surprise in Q3 was 83%, which was above the 5-year (78%) and 10-year (75%) averages. Overall, Q3 earnings are tracking towards increasing by 10.7% YoY.[2]

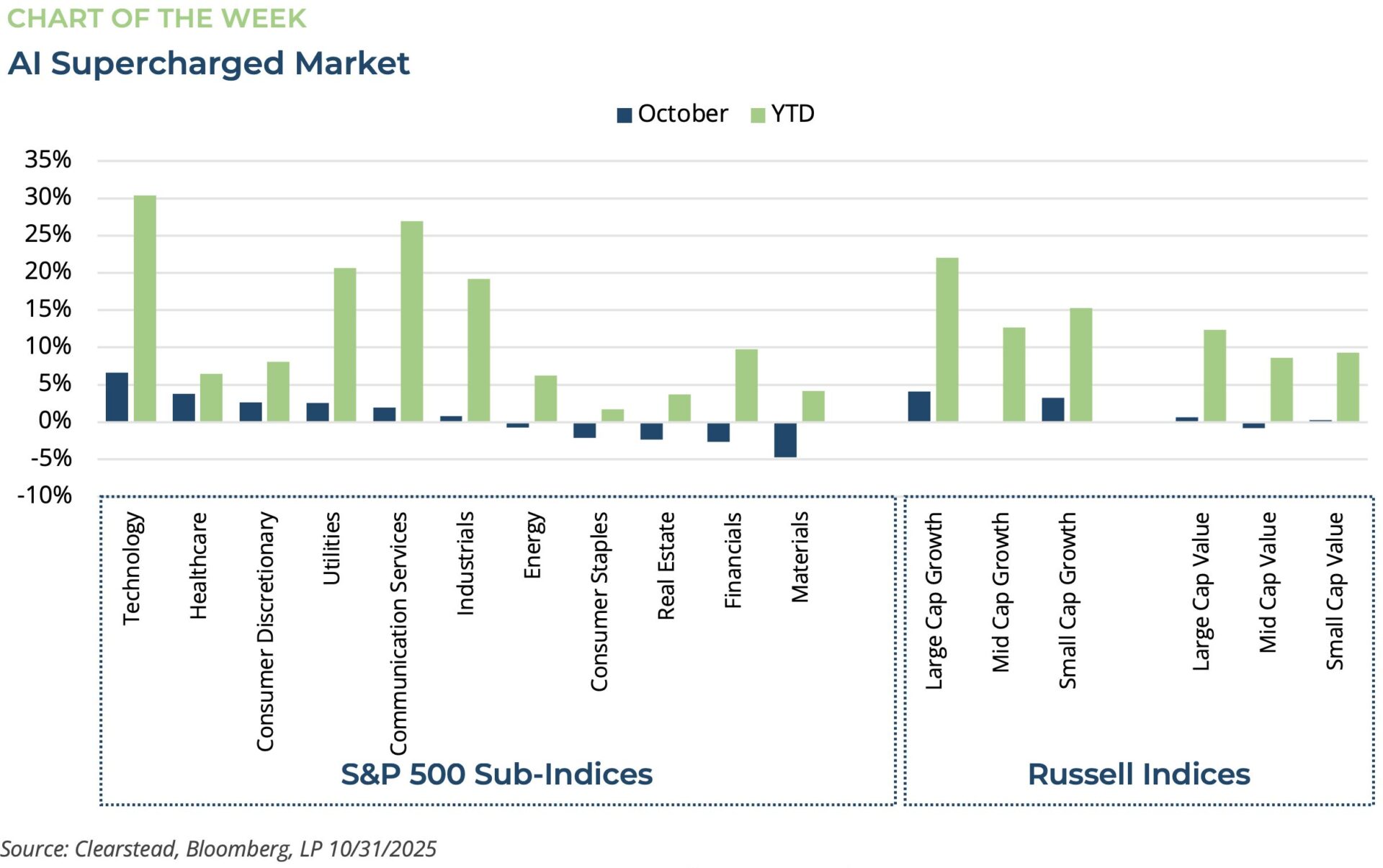

ONE MORE THOUGHT: October Sees Gains but Largely Confined AI-oriented Growth-Stocks[1]

October saw equity markets broadly make gains, but returns were not distributed evenly during the month with a relatively narrow group of AI-oriented, growth stocks leading the way while lower beta, more defensive stocks lagged during the month. The month started out with a bout of volatility that was touched off by a flare up in the trade ware between the US and China. Early in the month the Chinese announced changes to policy that could have significantly restricted the export of rare earth minerals and products that are essential to numerous high-tech components and electronics. In response, the Trump administration announced retaliatory tariffs over 100% on Chinese goods. As a result, the S&P 500 lost more than 3% intraday and the VIX—so called fear gauge—rose to as high as 25 in the days that followed. However, it soon became clear that the Trump administration was making progress towards de-escalating the trade conflict with China and the month ended with a tentative trade framework with China that cheered markets. In the meantime, Q3 earnings season kicked off to a strong start and the sentiment around AI names, semiconductors, and data centers continued to gain ground. As the month ended, the Mag-7 stocks—Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla—gained 4.9% in the month, while the S&P 500 ex Mag-7 stocks gained only 0.8%. Overall large cap growth stocks (Russell 1000 Growth Index) gained over 3.6% while their value peers (Russell 1000 Value Index) gained only 0.4% in October—see Chart of the Week. October saw eight new record highs for the S&P 500 and despite October being one of the most volatile months of the year historically, several equity indices closed out the month within a few percentage-points of all-time highs. In this environment we remind clients to focus on their long-term plan and stick close to target for risk assets.

[1] Bloomberg, LP 10/31/2025

[2] FactSet Earnings Insight 10/31/2025

Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.