OBSERVATIONS

- Markets traded higher last week with the S&P 500 gaining 1.6% and hitting three separate record highs—the NASDAQ and Dow Jones Indices also hit record highs last week—while small caps (Russell 2000) gained 0.3% and the yield on the 10-year Treasury fell 1 basis points to end the week at 4.07%.[1]

- Prices at the wholesale level (Producer Price Index – PPI) came in better than expected in August, with headline PPI falling to 2.6% year-over-year (YoY)—expectations were for a 3.3% YoY increase—while core-PPI, which removes volatile food and energy prices, also declined to 2.8% YoY—below July’s 3.4% YoY figure.[1]

- In contrast, headline inflation (CPI) increased in August to 2.9% YoY, in-line with expectations, and above July’s 2.7% figure, while core-CPI—removing food and energy—was unchanged from July at 3.1% YoY.[1]

- Small business optimism improved in August to 100.8 from July’s 100.5 reading. After hitting a year-to-date low in April (95.8), the small business optimism index has been above its long-run average (98) for four consecutive months.[1]

- Initial unemployment claims jumped last week to 263k new claims, which was a 27k increase from the week before—this is the highest number of claims in nearly four years (Oct-2021) and an abrupt departure from this year’s typical week, but potential fraud in Texas may have contributed to this number.[1]

- Consumer sentiment slipped in September to 55.4—the long-run average for this index is 85—down from 58.2 in August, as lower- and middle-income households particularly soured on their views of the economy.[1]

EXPECTATIONS

- The European Central Bank held rates steady for the second consecutive meeting last week, citing resilience in the European economy and more balanced risks to the economy after Europe struck a trade deal with the Trump administration that largely pegged tariffs at 15% for exports to the US.[1]

- Despite the fact that the latest headline inflation number moved in the wrong direction, markets are increasingly convinced that the weakening labor market (see One More Thought) will spur the Fed to cut rates up three times this year. Markets have priced in a 0.25% Fed rate cut in September, another similar cut in October and about an 80% chance of a third 0.25% cut at its mid-December meeting.[1]

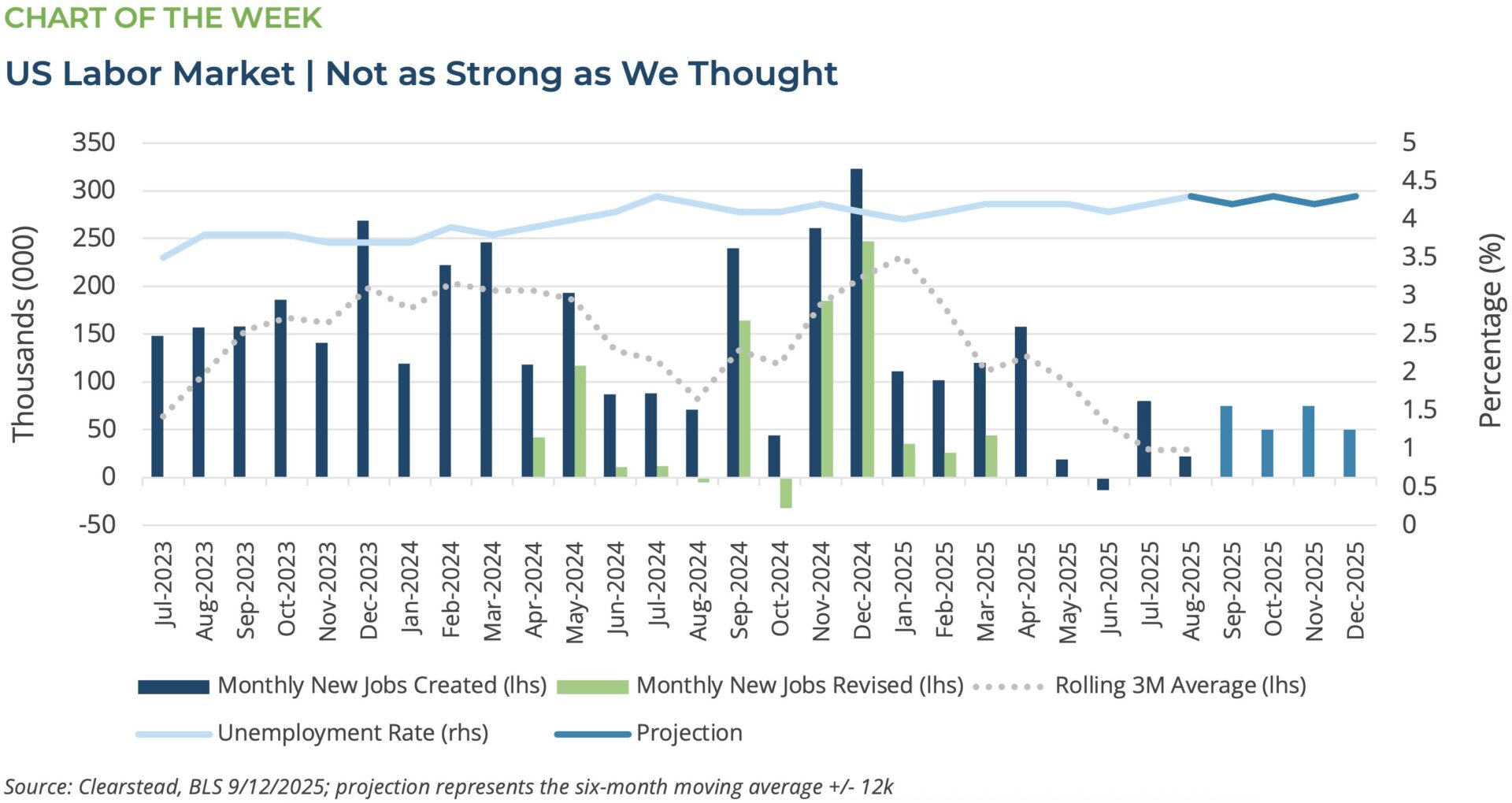

ONE MORE THOUGHT: The Labor Market Looking More Fragile than Resilient[1]

Over the past several months, this publication has been stressing that the US economy has been resilient (RC 25-Aug; RC 30-Jun) in large part due to the US consumer, who in turn has continued to spend as the US economy has been near full-employment. However, as part of its normal process, the Bureau of Labor Statistics (BLS) published its preliminary revision to the jobs data covering the period April-2024 to March-2025. The net result—of the 1.758 million jobs the BLS initially estimated were created over that period, over 910k (51%) of these jobs were never there (see Chart of the Week). This historically large revision stems from the fact that the initial estimate is made by the BLS based on the monthly payroll survey of about 120,000 firms, which has seen less than a 40% response rate in recent years. Whereas the revision stems from the BLS’s use of the QCEW data series—which covers over 12 million businesses and is based upon the unemployment insurance taxes that are paid to individual states by individual companies. Thus, the QCEW data—which is only available after a several month lag—provides a much more accurate estimate as to how many actual jobs were created in any given period. While the BLS’s monthly payroll survey is more timely, the lower response rates—as well as the embedded assumptions about how many new businesses are formed in each sector of the economy in any given month—have caused its job creation estimates to be overstated in recent years. This new data strongly suggest that the labor market has been a bit more fragile—averaging only about 75k new jobs created each month for the past 18 months—than previously assessed. Furthermore, this suggests that even a modest loss of economic activity could push the past year and a half of modest monthly job gains into modest monthly job losses. This is the backdrop for why markets are pricing in three consecutive rate cuts by the US Fed (see Expectations above). We have long held that so long as the US economy remained near full employment, US consumer spending would contribute to US economic resiliency even in the face of a new tariff environment, slowing growth abroad (see RC 8-Sep), and a moribund housing market. However, the recent increase in initial unemployment claims (if accurate) could portend more labor market weakness in the coming weeks and a real pull-back in consumer spending as we move into Q4. Equity markets seem uninterested in this scenario, while the bond market—the 10-year Treasury yield is down nearly 20 basis points month-to-date—may well have already begun pricing in weaker growth in the months ahead.

[1] Bloomberg LP, 9/12/2025

Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.