RESEARCH CORNER – APRIL 15, 2024

Download a PDF copy of this week’s edition here.

OBSERVATIONS:

-

- Markets fell last week with the S&P 500 losing -1.5%, small caps (Russell 2000) losing -2.9%, and the yield on the 10-year Treasury moved up 12 basis points to 4.52%, in part, due to the March inflation report.1

- Headline and core inflation came in higher than expected in March. Headline CPI registered 3.5% year-over-year (YoY) in March up from February’s 3.2% YoY figure, while core-CPI—which removes volatile food and energy prices—was 3.8% YoY in March showing no improvement from February.1

- Producer prices also showed uneven progress towards overall lower prices in the US economy. Headline PPI was 2.1% YoY in March up from February’s 1.6% YoY figure, while core-PPI—which also removes food and energy prices—was 2.4% YoY in March, which was higher than expectations and February’s 2.0% YoY figure.1

- Unemployment claims remained low at 211k last week, which was just below expectations and continue to signal that the US labor market remains on solid footing.1

- Small business optimism index continues to struggle, declining for the third straight month in March to 88.5—this index has now been below its 50-year average for 27 consecutive months and now sits at its lowest level since 2012. Small business owners continue to cite challenges with inflation and an increasing number are signaling that hiring activity is likely to slow.1

- Oil prices continue to rally to new highs for 2024. West Texas Intermediate Crude (WTI) started the year at about $70 per barrel and reached nearly $87 per barrel last week amid growing tensions in the Middle East (see Expectations Iran & Israel).

- The University of Michigan Consumer Sentiment Index fell in April to 77.9 from March’s 79.9 level—the index has been below its 70-year average since mid-2021.1

[1] Bloomberg LP, 4/12/2024

EXPECTATIONS:

-

- The release of Fed’s minutes underscored the main message coming out of most Fed officials’ remarks, namely that recent inflation data “had not increased their confidence that inflation was moving sustainably down to 2%” and that more evidence was needed with regard to the easing of inflationary pressures before it was appropriate to cut rates.1

- Iran has attributed an early April missile attack on its embassy compound in Syria, which killed seven Iranian military figures, to Israel and retaliated against Israeli forces over the weekend. This marks the first time in the now, six-month old conflict between Israel and Hamas where Israel and Iran have traded direct blows. The weekend attack on Israel looks to have caused damage at a few military installations, but no Israeli civilian or military deaths, thus far, have been announced. A wider conflict between Israel and Iran in the region has the potential to curtail global oil supplies as both Iranian oil production could come under fire as well as key oil export routes (Strait of Hormuz) could effectively be closed.

- Q1 earnings season got off to a mixed start, with JPMorgan and BlackRock largely delivering on Q1 earnings but providing less optimism on margins and growth going forward, while others, such as Citi and Wells Fargo saw expenses rise sharply, which pressured profits and earnings.1

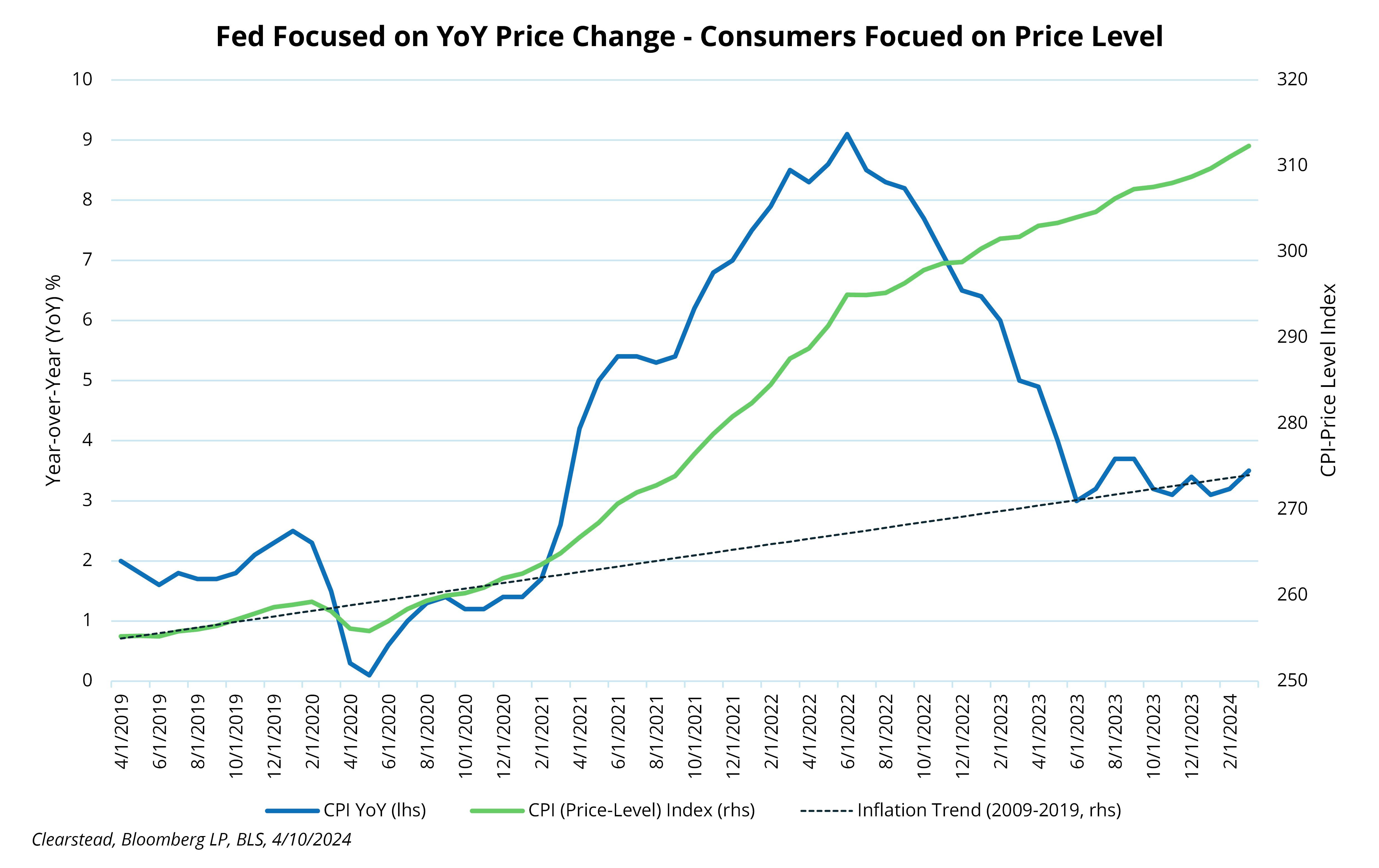

ONE MORE THOUGHT: The Fed focuses on the rate of change of inflation; consumers worry about the price-level1

Despite the Fed noting that significant progress has been made towards restoring price stability—Fed speak for getting inflation down to its target of 2%–consumers are much less happy with the state of prices in America. The Fed, for its part, is focused on the inflation rate, hence its 2% target, but that represents the rate of change in prices in the economy over the course of a year. What consumers continually reference to pollsters and via social media is the price-level because this is what they experience—it is no coincidence that the Univ. of Michigan consumer confidence index hit a historic a 70-year low the same month the inflation rate hit its peak in mid-2022. This means that even when the Fed ultimately delivers on its goal to get inflation back down to a 2% year-over-year rate, the overall price level will still be well above what it was pre-Covid—see Chart of the Week. What most consumers continue to focus on is that during the decade before Covid, prices moved upwards very gradually, and most consumers became anchored on these gradual price movements. If the pre-Covid trends had continued the price level today (see dotted line) would only be about 7% higher than it was at the end of 2019. However, because we experienced a period of heighted inflation between mid-2021 to mid-2023, the average price of goods is actually 21% higher than at the end of 2019. The gap between where most consumers “feel” prices should be versus where they are has caused a lot of angry spending and has weighed on broad measures of consumer sentiment that otherwise given the state of the economy (low unemployment, solid wage gains, strong stock market and high home prices) would have historically been associated with higher levels of consumer confidence.

CHART OF THE WEEK

Research Corner is a weekly article – produced by Clearstead’s Investment Office – that highlights weekly observations and expectations. Previous editions can be found in the Archive.

—————————————————

[1] Bloomberg LP, 4/12/2024

Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.

YOUR FUTURE IN FOCUS

At Clearstead, we create integrated, prudent, and custom strategies that bring clarity to you or your organization’s financial future.

Clearstead is an independent financial advisory firm serving wealthy families and leading institutions across the country. As a fiduciary, it provides wealth management services and investment consulting to help clients meet their financial objectives, achieve their aspirations, and build stronger futures.

SERVICES

INSIGHTS

CONTACT US

1100 Superior Avenue East

Suite 700 | Cleveland, Ohio 44114

216-621-1090

FOLLOW US