RESEARCH CORNER – APRIL 22, 2024

Download a PDF copy of this week’s edition here.

OBSERVATIONS:

-

- Markets moved lower for the third straight week, with the S&P 500 losing -3.0%, and small caps (Russell 2000 Index) down -2.8%. The yield on the 10-year Treasury continued to move higher, gaining 10 basis-points and ending the week at 4.62%.[1]

- Retail sales (excluding auto and gas) rose +1.0% in March on a month-over-month (MoM) basis, with the number significantly greater than expectations for a +0.3% gain. The strength in spending helped to push Q1 GDP estimates higher—the Atlanta Fed’s GDPNow model estimate for Q1 GDP rose from 2.4% to 2.9% following the release of March’s retail sales and housing starts data.[2]

- Industrial production rose 0.4% MoM in March but declined at an annual rate of -1.8% for the first quarter. Capacity utilization also edged up to 78.4%—but this is 1.2 percentage points below its long-run average.[1]

- The National Association of Homebuilders reported that home builder sentiment was unchanged in April at 51—this breaks a four-month string of monthly improvements in the index, but it remains above the neutral reading of 50 suggesting mild optimism in the sector over the coming months.[1]

- Housing starts, however, declined in March to 1.321 million units (annualized rate) down -14.7% MoM from February’s revised number of 1.549 million units. Compared to March-2023 new housing starts are down -4.3% year-over-year (YoY).[1]

- Similarly, existing home sales fell in March to 4.19 million units (annualized rate), which was -4.3% lower than February and -3.7% YoY below sales in March-2023.[1]

- Initial unemployment claims show no signs of labor market weakness. Claims last week were 212k, unchanged from the previous week’s level.[1]

EXPECTATIONS:

-

- The Fed’s Beige Book—a qualitative discussion of the economy in each of the 12 Fed districts—on balance showed that most of the country saw modest, but sustained, economic growth. Nine of the twelve districts reported increases in employment while the other three saw no change in jobs, while most districts noted that it was getting harder to pass along input price increases to the end customers.[3]

- About 14% of the S&P 500 have reported Q1 earnings and thus far 74% have beat earnings expectations—on par with the 10-year average—and the magnitude of the earnings surprise is +7.8% is also above the average beat size for the past 10-years.[4]

ONE MORE THOUGHT: Equity markets take a much-needed breather, bond yields break higher [1]

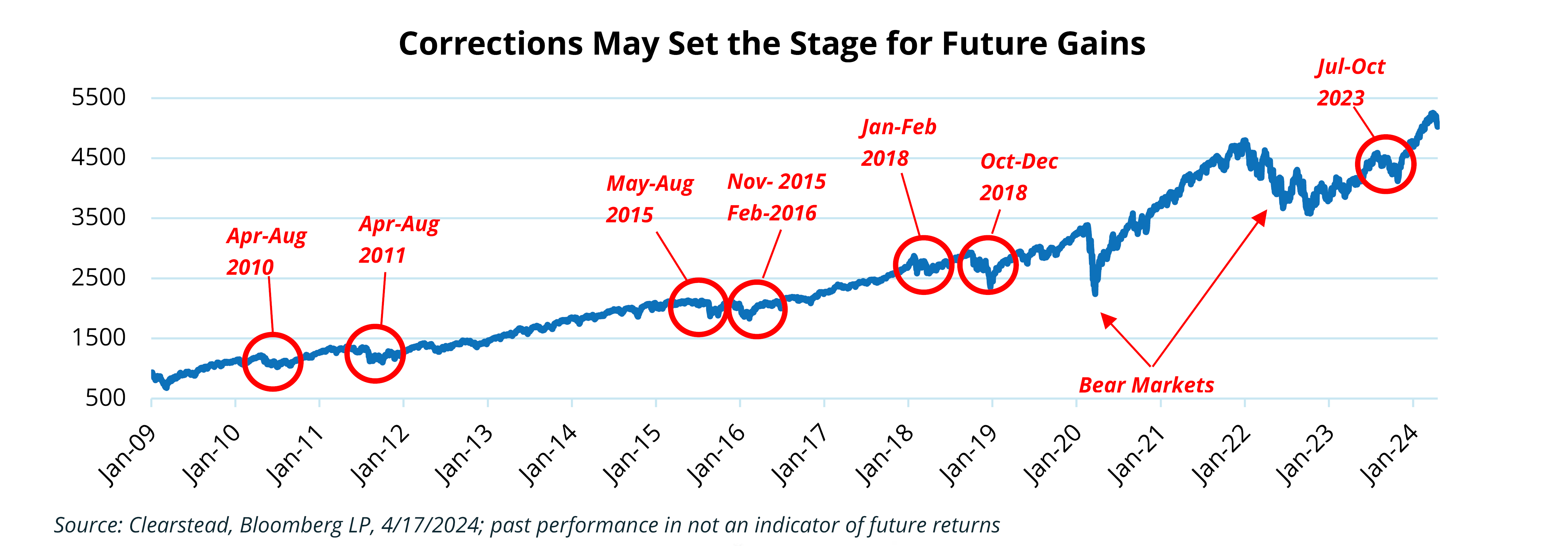

In Q1-2024 risk assets performed exceptionally well. The S&P 500 hit an all-time record high on January 10th 2024, but then kept moving higher. The S&P 500, all told, set 24 record highs over the coming weeks and ended trading on the final trading day of March at a record high of 5,254—having gained +10.6% in just one quarter. But it wasn’t just the S&P that did well in Q1. Small caps (Russell 2000) gained +5.2% during the quarter and high yield bonds (Bloomberg US Corporate High Yield Index) gained +1.5% while the broader bond market (Bloomberg US Aggregate Index) lost -0.8%. Investor sentiment was bullish as the US economy appeared stronger and markets understood that the Fed had signaled that it would, at least at some point in the year, begin cutting interest rates. But after three weeks of choppy trading in April, investor sentiment has cooled. Since the record high on March 28th, the S&P 500 has lost -5.4% and small caps (Russell 2000) are on the edge of a formal correction territory having shed more than -8.3%. Is this sell-off the beginning of a larger drawdown? Should it warrant a deeper re-think of portfolio positioning? On balance, this type of sell-off in equities is healthy. Often times a correction will see less-sophisticated, momentum-oriented investors exit the market and frequently sets the base for more gains to come. Also, while the record highs of Q1 were welcome, there was a case to be made that investor sentiment got ahead of equity market fundamentals. At the end of Q1, the S&P 500 was trading over 21 times expected earnings for CY2024—this is in the top 15 percent for richest markets in terms of S&P 500 valuations. Similarly, a number of technical indicators of positive sentiment such as relative strength or the VIX (the so called “Fear Guage”) suggested that bullishness had taken over trading in the final weeks of Q1. In fact, market corrections—declines of -10% or more (but less than -20%) from its most recent peak—occur on average about once every 24 months. Over the past 50-years, there have been 26 market corrections of -10% or greater S&P 500 drawdown and only six have turned into formal bear markets—when markets dropped over -20% from a recent high. The most recent correction occurred from July to October of 2023, and while painful it set the stage for the market’s rally over the past five months. Earlier in the year, Clearstead had judged that after an exceptional 2023—recall the S&P 500 gained +26.3%—that 2024 was more likely to generate positive, but more pedestrian returns, in mid-to-high single digits in-line with historic averages. Given that Q1 over-delivered on those modest expectations a bit of a market breather in Q2-2024 may set up an environment for steadier gains in the quarters to come.

CHART OF THE WEEK

Research Corner is a weekly article – produced by Clearstead’s Investment Office – that highlights weekly observations and expectations. Previous editions can be found in the Archive.

—————————————————

[1] Bloomberg LP, 4/19/2024

[2] Atlanta Federal Reserve, Bloomberg LP as of 4/16/2024

[3] https://www.federalreserve.gov/monetarypolicy/beigebook202404-summary.htm

[4] FactSet Earnings Insight 4/19/2024

Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.

YOUR FUTURE IN FOCUS

At Clearstead, we create integrated, prudent, and custom strategies that bring clarity to you or your organization’s financial future.

Clearstead is an independent financial advisory firm serving wealthy families and leading institutions across the country. As a fiduciary, it provides wealth management services and investment consulting to help clients meet their financial objectives, achieve their aspirations, and build stronger futures.

SERVICES

INSIGHTS

CONTACT US

1100 Superior Avenue East

Suite 700 | Cleveland, Ohio 44114

216-621-1090

FOLLOW US