In a down market, Clearstead’s advisors looking for the silver lining. We are proactively working for our clients to capture opportunities to protect and benefit them and their families. A few of these opportunities include tax loss harvesting, portfolio repositioning, and planning ideas.

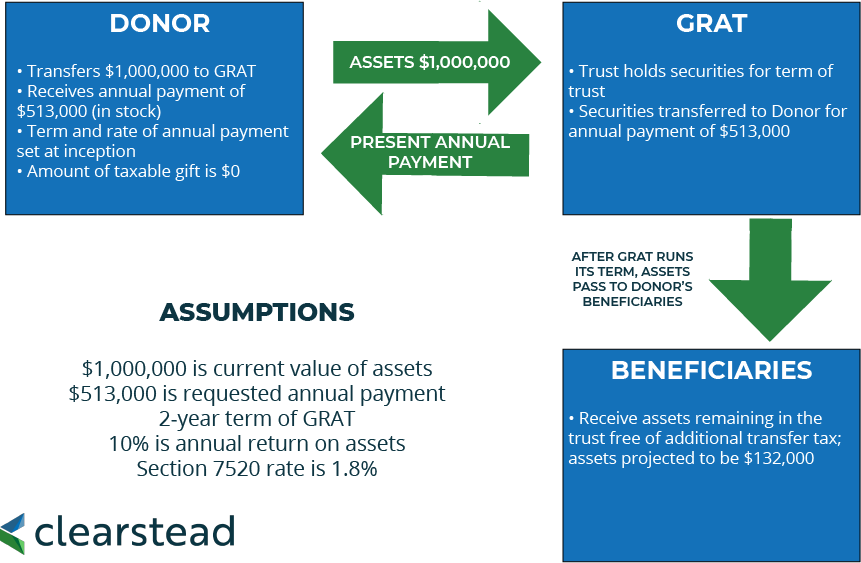

Planning involving a Zeroed-Out GRAT is one strategy that we are highlighting to our clients to take advantage of low rates and depressed equity valuations. This strategy allows individuals to gift the future appreciation of the equity markets to the Next Generation at a low cost.

What is a Zeroed-Out Grantor Retained Annuity Trust?

A grantor retained annuity trust (GRAT) is an irrevocable trust to which the grantor transfers property in exchange for the right to receive a fixed annuity for a specified number of years.

At the time the Zeroed-Out GRAT is funded and created, there will not be a gift tax obligation.

Advantages

- The Zeroed-Out GRAT makes it possible to transfer appreciation of assets to the beneficiary

- The assets remaining in the trust pass tax-free to the beneficiary, avoiding federal estate and state death taxes

- GRATs allow for privacy on the transfer of assets

- GRATs may provide asset protection from creditor’s claims

Disadvantages

- The trust is irrevocable.

- GRATs carry the risk that the grantor will die before the term expires resulting in the trust assets reverting back to the grantor’s estate.

- Legal fees for preparing the trust document

For illustrative purposes only and should not be construed as an advertisement or recommendation. Actual results may be better or worse than what is described in example.

YOUR FUTURE IN FOCUS

At Clearstead, we create integrated, prudent, and custom strategies that bring clarity to you or your organization’s financial future.

Clearstead is an independent financial advisory firm serving wealthy families and leading institutions across the country. As a fiduciary, it provides wealth management services and investment consulting to help clients meet their financial objectives, achieve their aspirations, and build stronger futures.

SERVICES

INSIGHTS

CONTACT US

1100 Superior Avenue East

Suite 700 | Cleveland, Ohio 44114

216-621-1090

FOLLOW US