RESEARCH CORNER – APRIL 29, 2024

Download a PDF copy of this week’s edition here.

OBSERVATIONS:

-

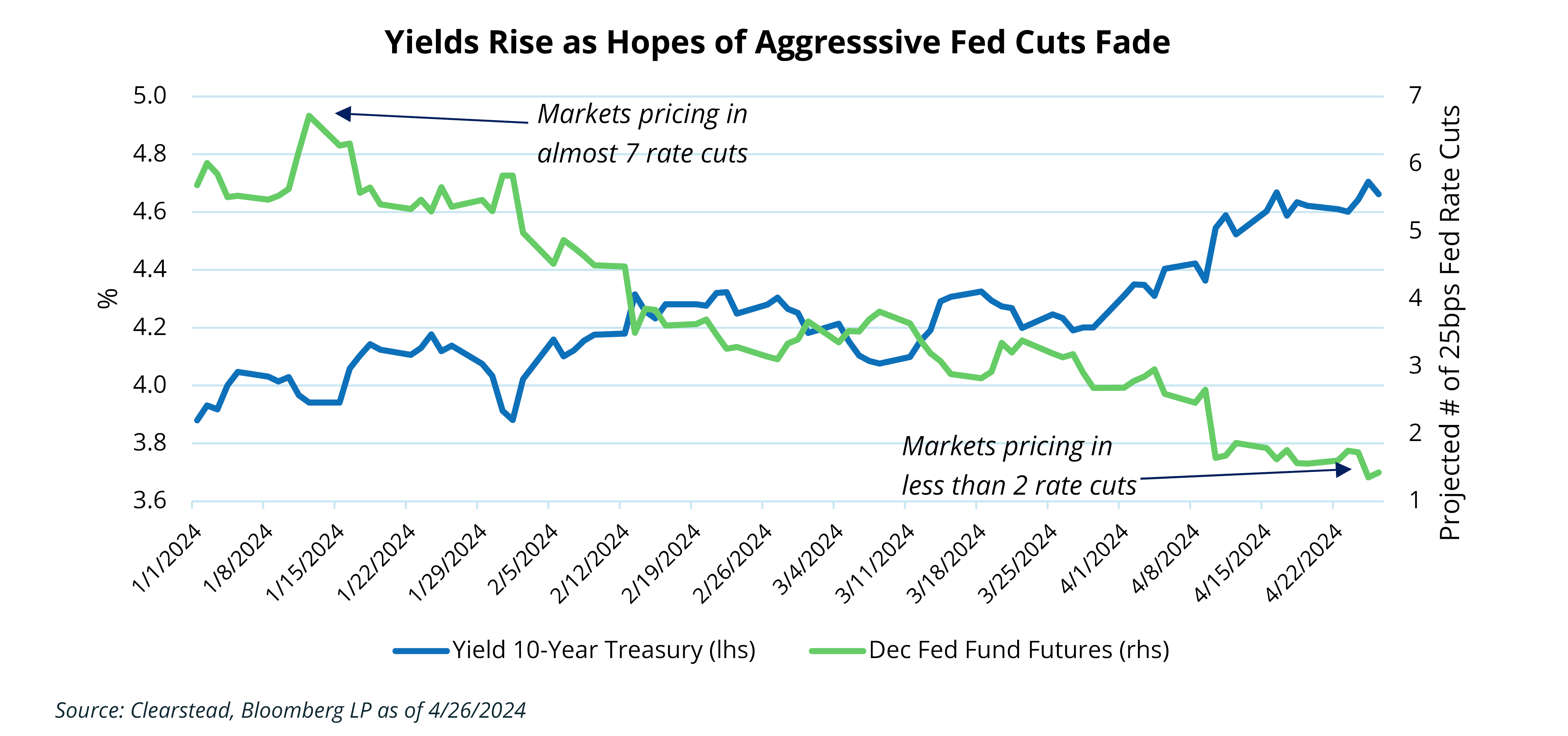

- Markets traded higher last week, snapping a three-week span of negative returns. The S&P 500 gained +2.7%, while small caps (Russell 2000 index) gained +2.8%. The yield on a 10-year Treasury continued to rise hitting 4.67% last Friday, a rise of 5 basis points from the week prior.[1]

- Sales of new single-family homes jumped +8.8% in March to a seasonally adjusted annualized rate of 693k homes, up from February’s downwardly revised 637k. The South and the West continue to dominate sales of new homes, with the two regions representing over 80% of new home sales activity.[1]

- Pending home sales moved higher in March increasing +3.4% month-over-month to 4.46 million (annualized rate), but remain -4.5% lower than in March-2023.[1]

- The initial estimates of Q1 real GDP came in below expectations at 1.6% (annualized), however the figure was dragged down by an increase in imports and a decrease in inventory levels—both of which can be volatile and may be more tied to inventory/supply-chain cycles than reflective of underlying demand.[1]

- The Fed’s preferred inflation gauge, the PCE index showed that headline prices rose 2.7% year-over-year (YoY) in March, which is higher than February’s 2.5% YoY figure but in-line with expectations. Core-PCE—which removes food and energy—remained at 2.8% YoY in March the same level as in February.[1]

EXPECTATIONS:

-

- About 46% of the S&P 500 have reported Q1 earnings, and thus far, 77% of firms have reported positive earnings surprises—which is on par with the 5-year average and better than the 10-year average.[2]

- The Fed meets again this week and on Wednesday Chairman Powell will hold a press conference to make “official” what Fed officials have been saying unofficially for weeks—namely that the Fed needs to see more evidence that inflation is moving toward their 2% target and they are prepared to delay any rate cuts until a series of inflation data-points gives them confidence that inflation is on a sustained retreat.[1]

- Nearly a billion Indians began to head to the polls last week in a general parliamentary election that will determine if the current Prime Minister Narendra Modi gets a third term in office. Modi enacted a series of economic reforms over his first two terms (2014-2018 & 2019-2024) that have ushered in a steadily growing economy—India is projected to grow by over 6% in 2024—that has benefited both rich and poor. India’s election typically takes several weeks given over 900 million votes could be cast and is set to conclude in early June, but Modi looks likely to win a third term as India’s Prime Minister.[3]

ONE MORE THOUGHT: End of April Recap – Rates Up and Equities Down

April saw the continuation of one of the most consistent features of this year, the gradual rise in the yield of a 10-year Treasury. At the end of March, the yield on a 10-year Treasury was 4.20% and as we wind down April it stands at 4.67%—climbing about 47 basis points. Recall that we started the year with a yield on a 10-year Treasury just below 3.9% (see Chart of the Week). The reasons for this increase in the 10-year Treasury yield are two-fold. On one hand, the market began to realize that its expectations for the Fed to begin cutting rates had to be tempered—both in the number of cuts to expect as well as their timing—as inflation prints for January, February, and March appeared to show that the decline in inflationary pressures had stalled. Secondarily, the notion that the US economy would weaken as the rate hikes of 2022 and 2023 began to bite largely faded. Despite the Fed’s hikes, the US economy looks stronger than expected and many economists have quietly increased their growth forecast for 2024. On balance, the stronger than expected economy has buoyed risk assets such as equities and high yield bonds, while the Fed’s caution has weighed on longer duration bonds such as 10-year US Treasuries. At this point, the Fed-Fund Futures have priced in only one Fed cut for sure this year—projected to be realized at the September Fed meeting—and the prospect of a second cut by year’s end is only about 40%. Given this, it is possible that should the US economy continue to surprise to the upside in May and June, the yield on the 10-year Treasury could re-test its previous multi-year high of 5%. As for equities, the volatility in the bond market may increase the volatility in equities as well over the next few months. However, while the bond market’s eyes seem to be fixed on the Fed, the equity markets are more likely to be focused on the strength of the US economy. The S&P 500 took a breather in April, giving back about 25% of the gains from Q1. The index’s April decline seemed to be blunted as the S&P approached its 100-day moving average, which was just above 4,900. As we look forward, it seems reasonable to assume that the S&P may be somewhat rangebound over the remainder of Q2 as markets determine if the recent positive economic surprises translate into greater corporate revenue and earnings growth for this year.

CHART OF THE WEEK

Research Corner is a weekly article – produced by Clearstead’s Investment Office – that highlights weekly observations and expectations. Previous editions can be found in the Archive.

—————————————————

[1] Bloomberg LP

[2] FactSet Earnings Insight 4/26/2024

Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.

YOUR FUTURE IN FOCUS

At Clearstead, we create integrated, prudent, and custom strategies that bring clarity to you or your organization’s financial future.

Clearstead is an independent financial advisory firm serving wealthy families and leading institutions across the country. As a fiduciary, it provides wealth management services and investment consulting to help clients meet their financial objectives, achieve their aspirations, and build stronger futures.

SERVICES

INSIGHTS

CONTACT US

1100 Superior Avenue East

Suite 700 | Cleveland, Ohio 44114

216-621-1090

FOLLOW US