The early days of the quarantine were unchartered.

The world rushed to stock up on food, household supplies and essential items. We worried about our own health and loved ones. We prepared for the unknown and sheltering-in-place.

We prioritized basic human needs.

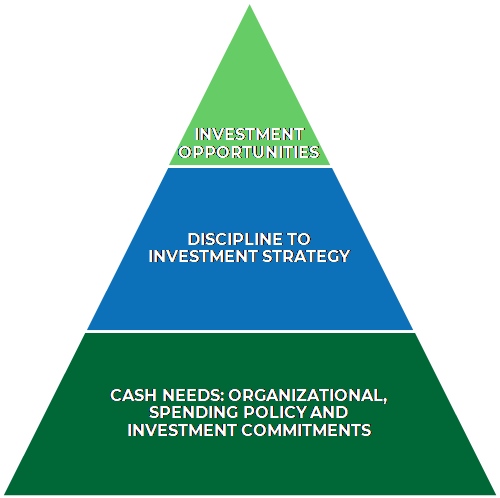

Clearstead helped clients prioritize their investments in a similar fashion. We started by attending to spending and cash needs.

As highlighted in last week’s post, challenging and uncertain times call for clarity and steadfastness. Our advice is simple and consistent: attending to basic needs and sticking to one’s investment strategy helps prepare to take advantage of opportunities as they arise.

Account for Needs First

Just like stocking the pantry with canned food and toilet paper, during volatile times investors should consider stocking their portfolios with cash. But how much cash?

During normal times, Clearstead can easily project client cash-flow and spending. We know because we ask, document, and track that information. Under abnormal circumstances, projections and needs change, and must be confirmed and possibly re-defined.

During periods of stress, we work closely with families, businesses, foundations, and operating not-for-profit organizations to determine how their cash-flow projections and needs might change. This process assesses declines in revenues, sources of government relief, spending and expenses, capital market performance, and potential capital calls for private investments.

All Clearstead clients typically have adequate levels of cash and diversification in portfolios to dampen unexpected shocks. When cash needs and risk-tolerance abruptly shift, we work proactively to account for near-term commitments, and build in adequate contingencies for longer-term needs. We lead the process to define what is needed, to account for those needs, and to communicate and document those details to key stakeholders.

Cash is Sacred

Most equities and some alternative investments are liquid. However, they may not be ideal sources of spending and raising cash during volatile times. Clearstead has recently advocated raising cash by reducing exposure to high quality bonds – notably treasuries, not investments that have seen declines in their market values.

Cash should be safe and operationally easy to access.

Bank and brokerage accounts accomplish this up to FDIC and SIPC levels, respectively. Beyond these levels, depositors must understand the creditworthiness of the institution in order determine the safety of uninsured deposits. Over these FDIC and SIPC levels, Clearstead looks to money market instruments given our preference to lend to the U.S. Government rather than a single institution.

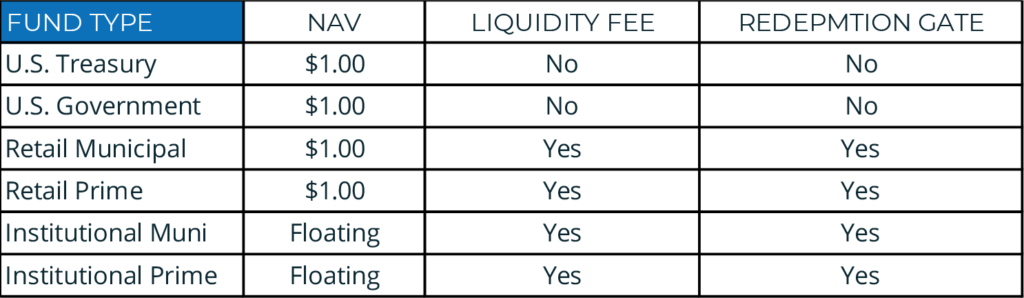

In 2014, the SEC enacted new money market funds rules that persist today. Our August 2014 Standpoint discussed these rules, which are summarized in the table below. Essentially, liquidity and NAV rules differ by investor type, and money market type.

Some money markets have a stable NAV and may not impose redemption gates (Treasury and Government Funds). Others may have a floating NAV and may impose gates during times of stress (Prime Funds).

We are aware of the potential give up in yield, but given the current differences between Treasury/Government Funds and Prime Funds (approximately 0.20% to 0.50%), we favor safety and certainty of access. Said another way, the yield spread does not support the risk of a floating NAV or redemption gate on access to funds. In summary, our four recommendations for cash positions:

- Safety and guaranteed access are of highest priority

- Take advantage of FDIC and SIPC, but understand its limitations

- Swim in the deepest pools – target the largest money market funds and providers

- Hold cash in U.S. Treasury and Government money market funds – note that many of these types of funds are soft-closing due to recent large in-flows

As humans, we sometimes take basic needs for granted. The quarantine has been a healthy reminder of what is essential in our personal lives and in investment portfolios.

Having attended to investor’s basic needs, Parts 3 and 4 of this series will shift focus to maintaining a disciplined approach to one’s investment strategy and capitalizing on unique opportunities.

Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision.

Performance data shown represents past performance. Past performance is not indicative of future results. Current performance data may be lower or higher than the performance data presented.

YOUR FUTURE IN FOCUS

At Clearstead, we create integrated, prudent, and custom strategies that bring clarity to you or your organization’s financial future.

Clearstead is an independent financial advisory firm serving wealthy families and leading institutions across the country. As a fiduciary, it provides wealth management services and investment consulting to help clients meet their financial objectives, achieve their aspirations, and build stronger futures.

SERVICES

INSIGHTS

CONTACT US

1100 Superior Avenue East

Suite 700 | Cleveland, Ohio 44114

216-621-1090

FOLLOW US