“The investor’s chief problem—and his worst enemy—is likely to be himself [or herself]. In the end, how your investments behave is much less important than how you behave.”

– Benjamin Graham

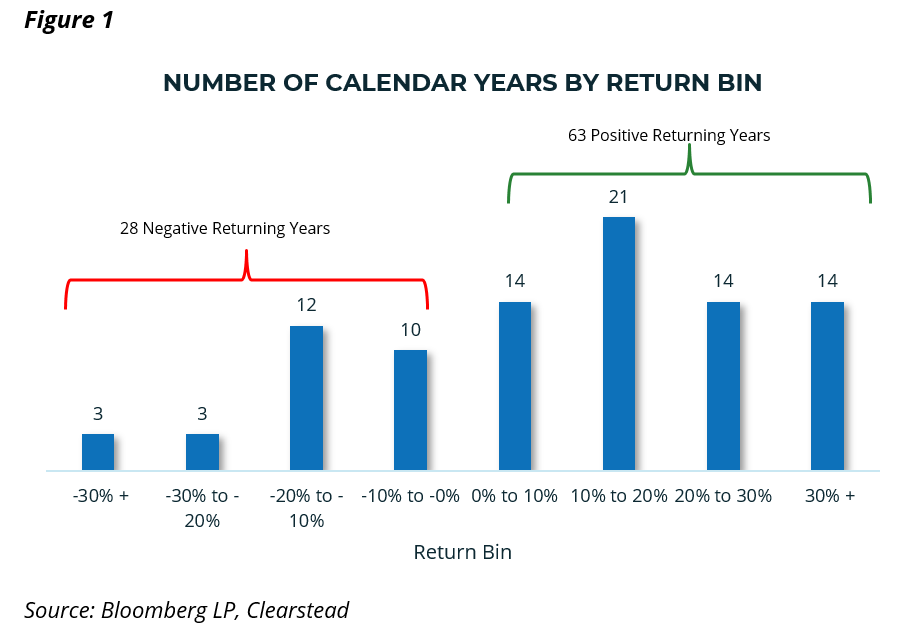

The discipline of sticking with an investment strategy or financial plan is often the most difficult part of investing. Volatility is an inherent attribute of investing. By way of example, the S&P 500 has had average annual returns of 8.6% since 1929 (91 years) with a standard deviation of 19.3% – meaning, 68% of all annual returns occurred between +27.9% and -10.6% [1]. In fact, only 4 of the 91 years had returns that were within 1% of the long-term average returns [1]. Additionally, 31% [1] of those 91 years were negative returning years (Fig 1).

So, we are confident in expressing the following: (1) Investors rarely, if ever, experience the average, and (2) investors are sure to experience volatility.

This, we think, is an important observation that reinforces the value of sticking to your investment strategy or financial plan. It is also a crucial next step after attending to basic cash needs to adhere to your investment policy statement. We discussed those needs in the previous edition of this series.

Relatedly, during these periods of volatility – which, as observed in Figure 1, occurs with more frequency than we tend to think – investors often make the mistake of trying to time the market. Market timing is notoriously difficult for even the most astute of investors.

As we highlighted in our Research Corner dated March 20:

“By way of example, if you would have missed the 20 best performing days over the past 20 years (ended Dec 31, 2019) your return would have been 0.08%, missing the top 10 days would have netted returns of 2.44%, while staying invested in the market would have yielded a 6.06% [2] return. Perhaps more telling is that 6 of the top 10 performing days occurred within days of the top 10 worst performing days. [2]”

A disciplined investment strategy or financial plan is a critical step towards investing success and understanding that volatility accompanies investing will help you stay the course. More importantly, volatility can be very useful to investors given an appreciation for the opportunities it affords. Those opportunities include:

- Rebalancing – Rebalancing allows investors to buy depreciated assets (e.g. equities) with potentially higher expected returns by selling appreciated assets (e.g. Treasuries) with potentially lower expected returns

- Investment opportunities – Extraordinary volatility generally accompanies, or leads, fundamental stresses in the economy, which may result in new investment opportunities

- Tax loss harvesting – Declines in broad asset classes can create significant ‘tax alpha’. Liquidating depreciated assets at a loss vs. cost basis can be a valuable tool for taxable clients

- Trading-up – Bear market sell-offs, where all risk assets trade down, provide investors a window to eliminate lackluster investments, possibly at lower tax costs, and add higher-quality strategies at reasonable valuations

Clearstead was proactively communicating with clients during the market decline in March to do exactly these things. We acted in discretionary accounts and quickly engaged non-discretionary clients.

Part 4 of this series, “Seek Opportunities,” will focus more on the specifics of these opportunities.

—————

[1] Bloomberg, LP, Clearstead. Calendar year total returns from 1929-2019.

[2] J.P. Morgan Asset Management, Market Insights – Guide to the Markets, Q1 2020 as of March 16, 2020. Returns are annualized.

Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision.

Performance data shown represents past performance. Past performance is not indicative of future results. Current performance data may be lower or higher than the performance data presented.

YOUR FUTURE IN FOCUS

At Clearstead, we create integrated, prudent, and custom strategies that bring clarity to you or your organization’s financial future.

Clearstead is an independent financial advisory firm serving wealthy families and leading institutions across the country. As a fiduciary, it provides wealth management services and investment consulting to help clients meet their financial objectives, achieve their aspirations, and build stronger futures.

SERVICES

INSIGHTS

CONTACT US

1100 Superior Avenue East

Suite 700 | Cleveland, Ohio 44114

216-621-1090

FOLLOW US